In Phoenix's diverse business landscape, extra liability insurance is a vital risk management strategy. It offers specialized coverage beyond standard policies, protecting businesses from unforeseen legal liabilities like slip-and-fall incidents. A robust operations policy, incorporating strategic risk management and adequate extra liability insurance Phoenix, is crucial for navigating elevated risks in commercial spaces. This policy outlines clear incident handling procedures, apports responsibilities, and cultivates a culture of safety. Regular reviews and engagement with insurance professionals ensure the policy stays aligned with evolving business needs and industry changes, safeguarding Phoenix-based commercial operations from potential risks and financial losses.

In the dynamic business landscape of Phoenix, navigating legal risks is as essential as strategizing growth. This article delves into the critical aspect of extra liability insurance, a game-changer for local businesses aiming to thrive. We explore why this robust safety net is indispensable and guide readers through crafting a comprehensive operations policy. From understanding coverage to implementing best practices, discover how to protect your Phoenix business from potential liabilities, ensuring long-term success and peace of mind.

- Understanding Extra Liability Insurance: Why It's Crucial for Phoenix Businesses

- Crafting a Comprehensive Operations Policy: Protections and Coverage

- Implementing and Maintaining Your Liability Policy: Best Practices for Phoenix Businesses

Understanding Extra Liability Insurance: Why It's Crucial for Phoenix Businesses

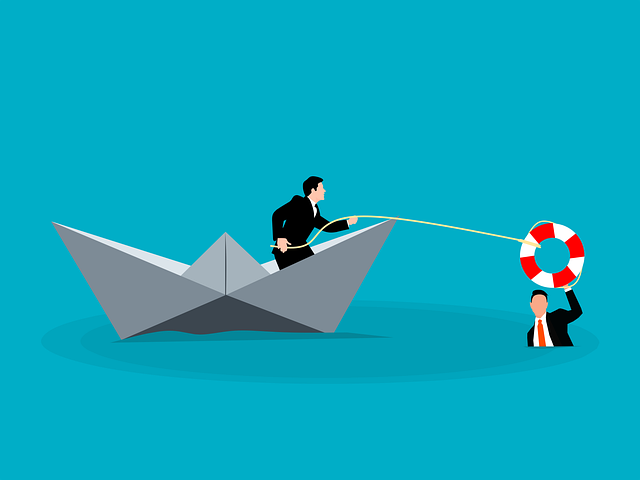

In the dynamic business landscape of Phoenix, where operations can range from bustling retail stores to sophisticated service industries, extra liability insurance stands as a cornerstone of risk management. This specialized coverage goes beyond the standard policy, offering protection against unforeseen and potentially costly legal liabilities. It’s not just about financial safety; it’s a proactive measure to safeguard the reputation and sustainability of Phoenix businesses.

For instance, imagine a scenario where a customer slips and falls on your premises, leading to injuries. Without extra liability insurance, a settlement or lawsuit could cripple your business finances. However, with this added layer of protection, you’re better equipped to handle such incidents, ensuring that your business remains resilient in the face of unexpected challenges. In Phoenix, where diversity drives the economic pulse, recognizing and mitigating risks through comprehensive coverage is a strategic necessity.

Crafting a Comprehensive Operations Policy: Protections and Coverage

Crafting a comprehensive operations policy is paramount for any business, but especially so for those in commercial spaces where risks are higher. This policy serves as a safety net, providing protections and coverage against potential liabilities that may arise during day-to-day operations. One crucial aspect to consider is securing adequate extra liability insurance in Phoenix to mitigate financial risks.

By incorporating robust risk management strategies and ensuring comprehensive insurance, businesses can safeguard themselves from financial ruin in the event of accidents, injuries, or property damage. An effective policy should outline clear procedures for incident reporting, investigation, and response, while also detailing the responsibilities of employees, vendors, and other stakeholders. Such a policy not only protects the business but also fosters a culture of safety and accountability, ensuring smooth operations and peace of mind for all involved parties.

Implementing and Maintaining Your Liability Policy: Best Practices for Phoenix Businesses

Implementing and maintaining a robust liability policy is paramount for businesses in Phoenix, ensuring protection against potential risks and financial losses. The first step involves assessing your operation’s unique exposure to liability claims. This includes evaluating activities, products, services, and premises to identify potential hazards. Once identified, specific insurance coverage should be secured to address these risks. An extra liability insurance policy tailored to Phoenix businesses is a strategic move, providing broader protection beyond standard coverage.

Regular reviews of your policy are essential to ensure its continuity and effectiveness. Stay updated on industry changes, legal developments, and evolving business practices that may impact your liability exposure. Engage with insurance professionals who can guide you in customizing the policy to align with your specific needs. Promptly address any policy gaps or updates, as they emerge, to maintain comprehensive protection for your Phoenix-based commercial operations.

For Phoenix businesses aiming to thrive in a competitive market, crafting and implementing a robust liability commercial operations policy is non-negotiable. By understanding the importance of extra liability insurance, developing comprehensive coverage that protects against various risks, and adopting best practices for maintenance, local enterprises can mitigate potential liabilities and safeguard their financial health. Investing in these measures ensures Phoenix businesses are equipped to navigate legal complexities and customer expectations, fostering long-term success in today’s dynamic business landscape.